Dear Students, If you get the same product on any other website at lower than this price, Kindly get in touch with our Sales Team at 9334338610. We assure you to provide same discount and some extra reward as well.

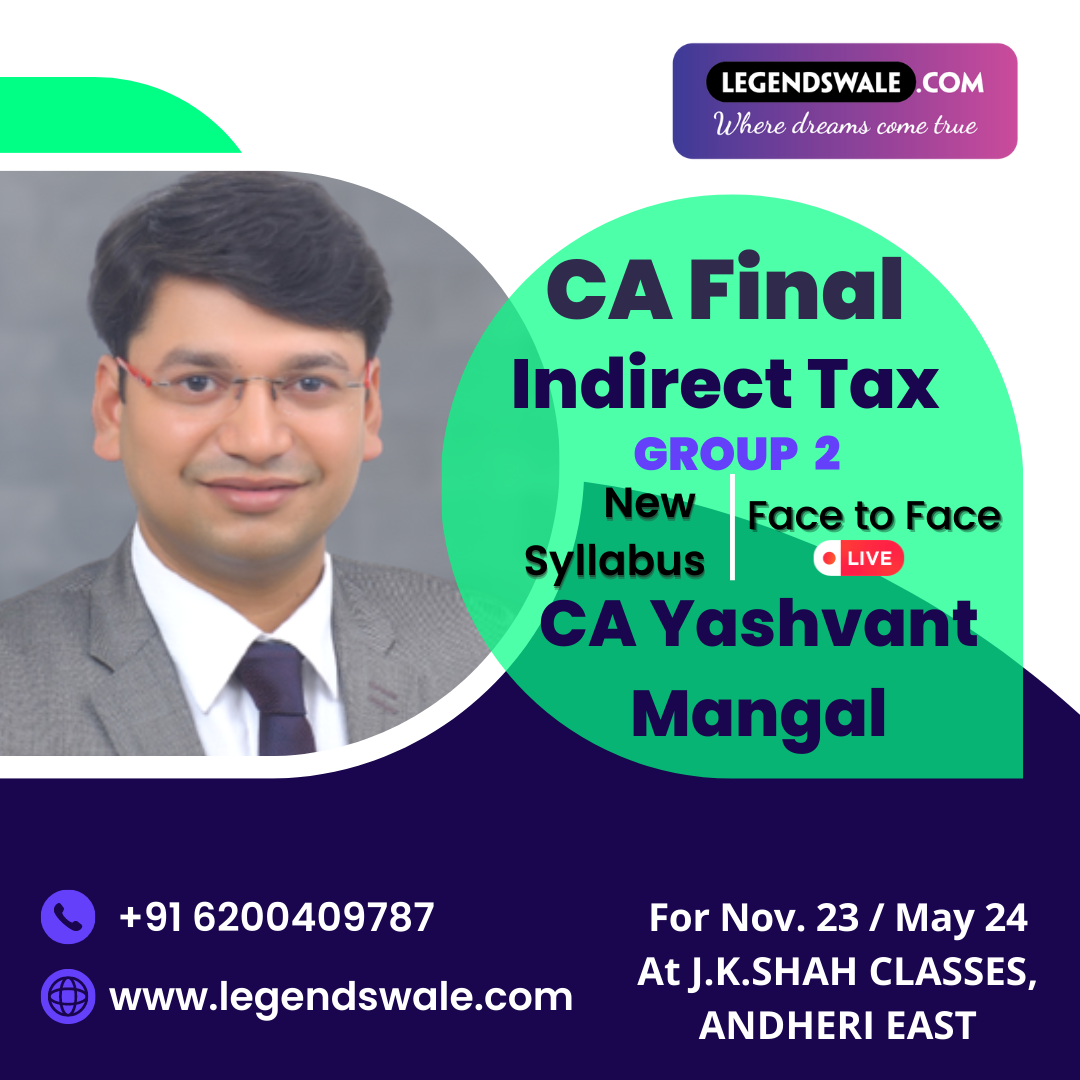

CA Final IDT In Depth Regular Full Course Batch For Nov.23/ May 24 By CA Yashvant Mangal

₹12,000.00

Course Info

| Faculty Name : | CA Yashvant Mangal |

| Course Level | CA Final Group-2 |

| Total Views | RECORDED BACKUP OF 40 HOURS |

| Video Language | English & Hindi Mix |

| Relevant Attempt | Nov 23 & May 24 |

| Batch Recording | Live Face to Face Batch |

| Study Material | 3 Volumes – Conceptual Learning Main Book, FREE QUESTIONNAIRE & Colorful SUMMARY BOOK, रामबाण Chart book |

| Runs On | Live Face to face batch |

| Doubt Solving | WhatsApp Support | Email Support |

| System Requirement | Live Face to face batch |

| Processing Time | Live Face to face batch |

| Delivery Time | Live Face to face batch |

| Note | Live Face to face batch |

Course Description

| Batch Commencement | 13 April 2023 |

| Batch Completion | 28.05.2023 |

| Syllabus (Old / New) : | New Syllabus |

| Format : | LIVE FACE TO FACE |

| Study Material Provided in : | Hard Copy |

| For Hard Copy Study Material, provide details (e.g. No. of Books, Hand Written Books, Colorful Books, Xerox Copies, No. of pages, etc) : | 3 Volumes – Conceptual Learning Main Book, FREE QUESTIONNAIRE & Colorful SUMMARY BOOK, रामबाण Chart book |

| Final Selling Price (Inclusive of All Taxes) : | 12000 |

| Applicable for the Attempt (e.g. May 2019, Nov 2019) : | Nov. 23 / May 24 |

| Faculty Name : | CA. Yashvant Mangal |

| Total No. of Lectures : | Approx. 35 Days |

| Total No. of Hours : | 150 hours Approx. |

| Video Language : | Hindi + English Mix |

| Timing | 7 AM – 10 AM (Mon. to Fri.)

7 AM – 2:30 (Sat. & Sun.) |

| Place | J.K.SHAH CLASSES, ANDHERI EAST |

| BACKUP | RECORDED BACKUP OF 40 HOURS |

| Topics Covered : | GST + Customs + FTP |

For More Details Whatsapp 6200409787

About Faculty

CA Yashvant Mangal is a Fellow Member of the Institute of Chartered Accountants of India. He is also a Qualified Company Secretary and a Commerce Graduate.

He is a Renowned National Level Author & Faculty of Indirect Tax Law for CA, CS & CMA Final students and Professionals. His Book titled as – “Conceptual Learning on Indirect Tax Laws” is available throughout the Country, of which 25 editions are already released.

He is an Eminent Speaker and is enormously passionate about the subject and has addressed many seminars and conferences on GST, Service Tax and various other subjects on different platforms including ICAI, Tax Bar Associations, Banks and various Trade Associations in various states including Maharashtra, Gujarat, Rajasthan and Madhya Pradesh.